The following Top Tender Tips are from the “other side” as a consultant representing the customer who is seeking tender responses. These comments are based on Corporate GIS writing and managing a large number of tenders over the last couple of decades ranging from $50K to $15m for government agencies, Councils, Utilities, and private companies.

#1 – Why it is necessary to be HONEST in Tender References?

When you’re responding to a tender and get to the section where they ask for references, how honest should you be?

VERY, is the answer!

A couple of years ago I was managing a tender for a major government agency – it was a GIS & Asset Management software and services tender (for several million dollars), and a number of the bidders were services companies fronting the usual range of software solutions. I was checking the references for the short-listed bidders and one referee said “Nah, never heard of them”. We talked for a bit, and he wasn’t joking – he really had never heard of the company who was giving the reference and never had any work done by them.

The bidder was making the reference up and never thought we’d check.

So that was the end of that bidder. If he was prepared to lie on his tender submission, then how could you ever trust his work. He probably did this all the time but had never been caught before.

Always, Always, tell the truth on tender references. Because the people evaluating can, and often do, call the referees to have a chat to get an understanding of how the bidder does their work, how they respond to scope changes, how they manage their contract and so on.

And if the vendor won’t give references because (they say) “that’s a breach of privacy”, then you know they’re lying.

Most happy clients are happy to talk with prospective clients of a vendor. So, if the vendor doesn’t have clients who are happy to talk to others, then that means that they are not happy clients, and likely very unhappy ones.

#2 – How to avoid Vendor low-balling

Almost every tender that we have managed has involved vendors trying to low-ball their price so that they win against their competition while selling their solution as the best and most sophisticated.

That is, they describe and demonstrate the Mercedes Benz solution without saying that they have given a price for only a Holden Ute (without any disrespect to a great ute). “But that’s dishonest”, you might say, “isn’t that like selling the sizzle without the sausage.”

So, there is always a need to make sure that vendors are honest in filling out their pricing schedules. If they really do have a great solution, then they should include the price of that solution, not try to low-ball it.

To ensure that this price is correct, I always make sure that the following clause is prominently shown on each pricing schedule:

“This schedule for this fixed price tender will be taken to include the costs for ALL items and features as bid by the Tenderer and which <customer name> will use to support the operational technology environment required by this tender. Any hardware, software, services, installation, configuration, maintenance, support, training, project management and consulting which is not included in this Schedule but which is shown in the tender response (either in the written tender response or as demonstrated during the tender evaluation) and is found to be required by <customer name> will be deemed to be included within the fixed price contract and must be provided at no additional cost to <customer name>.”

In effect, this clause says that if the vendor describes or demonstrated a software capability / feature in their bid, then it will be assumed that this capability / feature is included in the price if they are selected, and a contract is signed.

This effectively stops vendors from demonstrating the “bells and whistles” but then selling the basic solution, because they can only demonstrate that which they have priced. If they demonstrate some advanced feature, then it will be deemed to be included in the price and must be provided at no additional cost.

This stops vendors from low-balling dead in their tracks.

#3 – How to stop Vendors no-balling

Almost every tender that we have managed has involved vendors trying to low-ball their price.

Some even no-ball their price and try and get away with it.

This is how they do it.

Instead of providing a price in the pricing schedules, one large established vendor responded as follows:

“The cost for the implementation of customised functionalities with bespoke application development is not included in our response. This is due to the necessity to discuss with Council to identify the specific functional requirements to achieve Council’s desired outcomes. We can work with Council to establish the essential customisation requirements in a separate engagement”

The “specific functional requirements” were listed in detail in the tender document. Every other vendor had managed to provide a price for them, but not these guys.

In other words – they were saying “award the contract to us and then we’ll tell you how much it will cost.”

Needless to say, that didn’t work.

So, we told them they had 2 options:

- Because their response did not include a completed pricing schedule, they would be rejected within 24 hours, or

- They could re-submit the pricing schedule with prices just like all the other vendors did.

But because we had to compare prices between vendors, we told them that we could alternatively estimate their price for comparison purposes by estimating the number of days multiplied by their rate which they had provided in another schedule. They didn’t like that idea, at all.

What a surprise, they decided to fill in the schedule and provide a price. And guess what – their total price rose by 30%.

And that was the reason that they didn’t want to put in a price in this schedule – because they thought it would blow them out of the water – and it did.

This approach stops devious vendors in their tracks.

#4 – Why is spatial data so important in Tender evaluations

In some GIS systems, spatial data is intrinsically “tied” to the way that the software expects the data to be, particularly for some spatial applications such as utilities. If the data is not formatted correctly, then the software may ignore it, or worse still it may mis-interpret it. So, it makes sense that you know about this BEFORE you buy, not after.

Added to that, the ability for the GIS to integrate with your other systems, such as assets, rates, etc is going to be vitally important when the system is running in your workplace.

That’s why it is important to make sure the GIS works with YOUR data, not the vendor’s data which they have practiced with a large number of times and has most likely been heavily optimised to provide good performance and quick searching.

Then if you do buy that system, you know how it operates using YOUR data and on YOUR business processes.

That’s why it is important that tender evaluations include “scenario testing”. That is, undertaking a cut-down version of several of YOUR business processes using YOUR data. So, if you do end up buying that system, you know it will work in YOUR environment with YOUR data. And in the middle of a scenario test, you should give the vendor additional data to see how they load/use it.

Some vendors will try and talk you out of doing this, telling you how difficult this will be for them and suggesting that there is not going to be any difference with using their data. But make them prove it – after all, you wouldn’t buy a car without a test drive, so why should a GIS be any different?

#5 – Why is Probity Essential in Tendering?

A couple of months ago we received a Request for Quotation (RFQ) from a Local Government organisation in Victoria.

This RFQ was for a project which was a continuation of annual projects done over the previous 5 years. The RFQ included last year’s report done by a competitor. The RFQ website showed reports from the same competitor for previous years.

Had the competitor already won the job and the RFQ “process” was just for show?

Was the RFQ even legit?

Were they genuinely seeking alternative proposals, or just “going through a process” to justify re-engaging the same company?

Responding to a RFQ takes time and effort, particularly to do a quality proposal. So, was it worth the effort when it looked like it was already a “done deal”?

When you are spending your own money, you can buy what you like, but when you’re spending taxpayer’s money (as was the case with this organisation), it is important to seek a range of prices and honestly, fairly and transparently evaluate them to get the most cost-effective outcome.

That’s where probity comes in. There is federal legislation about probity.

Probity is MANDATORY for government, local government and most large corporations.

To ignore probity is to invite Ministerial scrutiny and, in some extreme cases, corrupt conduct findings.

Bureaucrats and politicians have gone to jail for ignoring probity rules and running sham RFQ’s.

So, with what was the outcome of the RFQ?

What a surprise – the competitor won again as they had done for the last 5 years.

Was this a proper evaluation and a legit process – doubtful.

Will we respond to the RFQ when it comes around next year, particularly given the work involved to do a professional response? What do you think?

#6 – Why do Vendors often self-select to lose?

All Tenders have a winner (except for unusual circumstances), so the focus is usually on selecting the winner.

The winner should be the vendor who has the best solution, is the most cost-effective (not necessarily the cheapest) and has the track record and customer base to support all this.

But the tender process should also ensure that the losers “really have lost”.

What do I mean by this?

Ideally there should be defensible reasons for why losing bidders have lost. This is really important so that there is acceptance by the vendor community (particularly by those that lost) that the tender process has been run properly, that the winner really has won, and won correctly, and that probity has been maintained.

This process is helped enormously when Vendors self-select to lose!

Some time back, I published an article in Position magazine about how some vendors adopt the Bradbury approach during tender evaluations (so named after Steven Bradbury who won an Olympic gold medal in ice skating in 2002 when all of his competitors fell over.)

The article is included in one of the blogs – still worth a read.

#7 – Separating the demo from the jock

We’ve all seen the slick demo’s given by vendors, making it look really easy, particularly for GIS software. And then you try it yourself and find it isn’t as easy as it looks.

Often this is due to:

- the demo jock is good at what he/she does and has extensive experience in making it look really easy

- the demo jock has used the data for the demo lots of times before and knows what to expect from each query, often because they have built the data to show the query performing quickly and correctly

- the demo jock runs through standard business process functions, not your specific ones

As obvious as it sounds, the purpose of a software tender is to buy the software, not the demo jock.

So how do you separate the jock from the demo when you’re trying to evaluate tenders.

That’s a really good question.

One of the easiest ways to remove the demo jock’s slickness is to make sure the demo is done using your data on your business processes.

You may not totally eliminate the need to “see past” the jock’s capabilities, but it will make it easier for you.

#8 – Vendor Comments

Recently I’ve had some email comments about some of my recent Top Tender Tips posts, mostly from vendors who disagree with an aspect of a post.

Over the years I have found that most vendors are self-absorbed in their product and can’t understand why we wouldn’t promote their software saying things like, “we’re the biggest GIS vendor on the planet, why wouldn’t you recommend our software”.

Or they try and shoot the messenger by saying, “what would you know” and in so doing try to denigrate my comments. And on it goes…

As such, we’ve come in for our fair share of adverse comments over the last couple of decades. It goes with the territory that when you are impartial and independent, not everyone will be happy with what you say. Particularly when you “tell it like it is” about the capabilities of some software product.

Vendors get angry because they don’t like people saying things which they consider to be “bad”, about their product.

We’ve also done over a dozen industry surveys in the Spatial Information Industry over the last 20 years or so, with the reports distributed to industry participants. In addition, we’ve also done a similar number of specific surveys and vendor product comparisons for private companies, with “warts and all” reporting back to them.

One vendor even threatened to take us to court because our reporting of industry statistics on his product didn’t show his company in the best light. This was industry responses that we were reporting, not our personal comments.

The industry thought his product was poor, so we said that, politely. His response was to threaten us, because he couldn’t understand how anyone wouldn’t see that his product wasn’t “the best”.

Our response to his threat to sue us was “Go ahead, make my day”, as the great Clint Eastwood said.

Therefore, in an industry full of vested interests (mainly from vendors trying to sell their products), who are you going to offer as the “trusted source” when the CEO is asked to sign off on the tender outcome.

All CEO’s that I have met are not stupid (that’s why they are the CEO), and they will be looking for a properly run and fair tender which meets probity guidelines and has demonstrable outcomes which meets the functional needs of the organisation.

How will your next tender measure up?

#9 – Tender Pricing

Tenders are more than just submitting prices. They are also about capability, experience, credibility, resources, trust, R&D strategy and so on.

But most vendors focus on pricing, because that’s where the sales rep earns his/her money and that’s how the vendor makes money and (hopefully) earns a profit to keep the whole ship afloat.

Pricing is also the major issue that the customer fixates on, because everyone has a limited budget, and the tendered price must be within that budget.

So, what is the strategy that most vendors use when it comes to pricing on tenders?

Go low. Go low. Go low.

The Vendor’s mantra is to beat their competitors, almost at any cost – that’s why they “low-ball” their tenders. They demonstrate the Rolls Royce (unless you’re very careful during the demonstrations) and then they sell you a Holden Ute. They do this to sell you the promise of the Rolls but for the cost of a Holden Ute which will (hopefully) be less than their competitors.

But then how do Vendors make their money if they continue to “low-ball” their price all the time?

The secret is variations.

Most tenders are vague and full of holes in specifying the functional requirements. So, unless you have a very good tender specification, a Vendor will price what you have vaguely asked for in the tender, and then when the contract is signed and you go to implement the system, that’s when you will hear those words “Oh, is that what you wanted”, while they express surprise that you actually wanted the system to work.

Then the next set of words you will hear is “well, that will be a variation and will cost you an additional $x to implement”. By this time, the contract is signed, and the Vendor has got you “by the throat”. You have nowhere to go but to agree to their inflated variation if you want the system to work.

This is how Vendors get the price back up to where it would have been if they didn’t have to low-ball the tender to win.

Is this legal or even ethical? You decide, but it is the reality when dealing with vendors and tenders.

That’s why is it so VERY important that you have a tight specification (so it is not vague, and variations cannot be argued) and to ensure that they only demonstrate what they have priced (so you can see what you are getting).

So, how will your next tender measure up?

#10 – Functional Requirements

Defining your functional requirements are critical when tendering for a GIS.

Think of it like getting your house plans drawn up before you get a quote from a builder. You wouldn’t think of just getting a builder to build your house without getting plans agreed. Even ignoring Council requirements to get building approval, it just wouldn’t make sense to start building your dream home without having plans showing where the bedrooms are going, where the cupboards are, what type of kitchen would you want, etc.

So, why do a number of organisations do just that when they go out to buy a GIS? They pay scant attention to the functional requirements (ie the house plans) and then wonder why they haven’t got the GIS they wanted.

In tender tips #9 I discussed the need for having well defined functional requirements in order to avoid variations. But it’s even more basic than that.

If you can’t define what the business functions are that you want the GIS to do, then how can you expect the vendor to know what you want to do. And how can you know that you have achieved the milestones set in the tender unless you have defined those milestones?

Unfortunately, most tenders are vague and full of holes (functionally speaking), so many people are setting themselves up to fail when implementing GIS. Vendors will implement that which you have defined in the contract coming out of the tender, and unless your requirements are well defined, then the chances are that they will not be what you want.

That’s why is it so VERY important that you have a tight specification so that you get what you want and need, not what the vendor thinks you want and then charges you variations to get it to what you need because you haven’t defined those functional requirements in your specification.

So, how will your next tender measure up?

#11 – Writing a GIS Tender Response

A competitor’s recent LinkedIn post on how to write a tender response opened with “Writing a tender is like writing a job application ― your goal is to convince someone why you are the right company to hire. The big difference is that with tender writing, you’re setting your own price for the job, which will have a big impact on whether you secure the contract.”

The focus on price again misses the point. The vendor is not setting the price – the customer already has a budget price window.

Then they partially redeem themselves by saying “… it is not necessarily offering the lowest price but building a strong case for why you can provide the best outcome for the project to justify your final price.”

Their advice listed 9 points, most of which are confusing or just plain wrong:

Points 1 “use simple language” and Point 2 “keep it short” are obvious – really, if this needs to be spelt out, then the vendor shouldn’t be in this business.

Point 3 – “answer the criteria” is obvious and is probably the most important point, assuming the customer has stated the criteria (ie the functional requirements) in sufficient detail to provide cogent responses. But make sure your response answers the customers criteria, not some vague generic meaningless statement such as “spatially enabling the enterprise”.

Point 5 – “stick to a template” – NO. Please do not provide template boilerplate or PowerPoint slides masquerading as information. Be informative and provide a response with contains real and useful information to address the customers’ requirements.

Point 6 – “understand the process” – yes, of course. But even if your capability doesn’t meet the process, give the customer a bit of credit that they know what they are doing. The common response given by many vendors is “why would you want that” (even if it is implied) as they go about providing an answer to the question that the vendor thinks should be asked, not what was asked.

Point 7 – “use examples” needs to be appended by “sparingly”. The customer only needs to know that you’ve done it before in their domain, and excessive use of examples just leads to verbiage likely not read.

Point 8 – “outline your approach” is obviously needed but should be included in “understanding the process”. That is, “how can our approach meet your requirements”

Point 9 – “proofread” – duh!!

So, how will your next tender response measure up?

We can provide assistance with tender responses for vendors, but only for tenders we are not managing.

#12 – Developing a Functional Requirement Specification

Previous Top Tender Tips highlighted that a tender is a lot more than getting a price. It should be about ensuring that the technical components of the GIS system match your business requirements, so that the system does what you need it to do.

It’s a bit useless having a tender that says, “we want a GIS” without defining what business functions the GIS should be able to do.

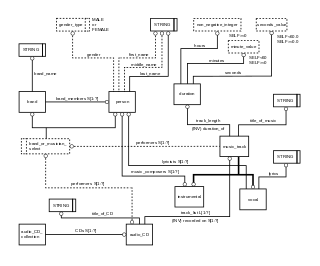

That is, the tender must include a reasonably detailed specification listing HOW and WHAT you want the GIS to do. That is, a Functional Requirements Specification (FRS).

So, what is an FRS? An analogy is that the FRS is the “house plan” for the house (the GIS) that you are going to build. You (obviously) need to tell the builder how many bedrooms you want, where they are going, where the cupboards are going, how big the kitchen is, and so on and you do that with a detailed plan of the house. You don’t need to tell the builder how to nail the studs or to sheet the wall, but you do need to tell him the bigger picture.

In the same manner, the FRS tells the vendor the broad sweep of the business functions that you want to do. You don’t have to include basic stuff like how to zoom and pan (cf: how to nail the studs or to sheet the wall from the analogy), but you do need to include major components, such as linear topology requirements (if needed), database connectivity (if required), analysis requirements, integration with other systems (eg asset management), 3D, etc.

The FRS also becomes the criteria against which you evaluate the tenders so (hopefully) you can get the vendor to work through a selection of business scenarios to show how their software can do the business function required.

That is, the FRS becomes the pivotal part of a tender:

* Get the FRS wrong and you either end up making the wrong purchasing decision and get a system that doesn’t do what you want, or you spend a lot of money in variations fixing the system.

* Get the FRS right and the GIS system is implemented smoothly within budget and meets all of your business requirements.

So, how will the FRS in your next tender measure up?

#13 – Probity Essentials

Maximising PROBITY in government tenders is essential – particularly if you want to keep your job!

Most probity problems come from a perception of undue influence by a Vendor, or favouritism towards one Vendor over another. These problems are usually manifested when another vendor complains to the Head of the Department or Minister.

That is when your career may become terminal if you haven’t done everything correctly.

Obviously, you should treat all vendors equally and without favouritism, but how do you show that this has been the case if a complaint is made, and you have to prove that all the correct procedures were followed.

The easiest way is to keep a diary (paper or digital) showing all contacts, including phone calls and emails with each vendor, with dot points of what they said, and what you responded, etc. In that way you can show a record of all vendor contacts if there is a complaint. While having a diary doesn’t prove that you did the right thing, it is a very good first step and, importantly, it will demonstrate to the boss that you are diligent and taking this process seriously.

Another step is for each member of the tender evaluation team to sign a statement attached to the Tender Evaluation Plan saying that they have no vested interests in any particular solution and that they will evaluate each tender equally and impartially. Each team member also needs to keep a diary of vendor contact.

From having run a large number of tenders, I have found that vendors are very good at informally contacting team members and subtlety seeking information or trying to influence the direction that the team is taking. By diarising each of these “contacts”, the team member can protect themselves against future allegations of bias if it comes to that.

Of course, a Tender Evaluation Plan is essential and must be signed-off by the project sponsor.

So, how will your next tender measure up?

#14 – Managing Scope Creep

The scope on almost all IT / GIS projects will increase, sometimes greatly, unless properly managed. This is particularly true at the specification development stage.

In our experience, the reason for this is because most stakeholders don’t put enough effort into thinking about their requirements at the start of the project.

It is only when the project “becomes real” and budgets and deadlines get set, that the stakeholders start to take things seriously and really think about their requirements. Of course, the stakeholders should’ve developed their requirements when asked at the start of the project, but they don’t.

This is when the scope starts to change, with a consequence that the budget and the timeframe will change accordingly. That is why it is prudent to build in a significant contingency (usually 20-40%) on the budget to allow for this eventuality.

One of the best ways to keep this under control is to make sure that the stakeholders who want to change the scope (and therefore the cost) bring their own budget to the table and submit a “change request” for every modification (with the appropriate budget).

That usually stops them stone cold from making endless changes because they hadn’t put in the effort into defining their requirements in the first place.

After all, if you’re the project manager, it is YOUR responsibility to bring the project in on-time and on-budget and the best way to do this is to stop stakeholders continuing to make unnecessary changes at the 11th hour.

So, how well do you manage scope currently?

#15 – Why do you need a Tender Evaluation Plan?

It’s always useful to have a plan before you start a project, otherwise you might not get to where you want to go. And a tender is no different.

It’s wise and it’s necessary to have a Tender Evaluation Plan BEFORE you go out to tender and certainly BEFORE you start the evaluation process. And all stakeholders need to agree on this plan.

If you represent a government agency, Council or Utility, then a Tender Evaluation Plan is an essential document to meet probity guidelines. That’s also why you need to have one.

The Tender Evaluation Plan should describe in detail the process whereby you and your team:

· will evaluate the tender

· how scoring will be done (including a sample scoresheet)

· what the weightings are for each category or functional grouping

· whether a group team score will be used or individual scores

· allocation of team’s “specialities” as part of the evaluation

· how gross scoring disagreement in the team will be managed

· how the reference checking will occur

· whether there is a process to review each company’s financials

· whether there will be a separate process for the pricing evaluation as well as the technical evaluation

· how demonstrations will be managed

· whether scenario testing will be used

· whether there will be a reference group attending demonstrations and if so, their part in the overall evaluation

· and so on

It is also important (and usual) for each member of the tender evaluation team to sign a statement in the Tender Evaluation Plan saying that they are impartial and have no vested interests in any particular solution.

When this Tender Evaluation Plan is completed and agreed to by all stakeholders, it should be signed-off by the project sponsor.

At the end of the evaluation, your Tender Evaluation Report can then show how you progressed through the plan and arrived at the final tender decision. This then gives the Executive confidence that the final decision is the correct one.

So, how will your next tender evaluation measure up?

#16 – Is a separate Pricing Evaluation Team necessary for a Tender Evaluation?

Most people evaluate a tender by focusing on:

· the technical / functional requirements, and

· the price

Most people initially focus on the price (it’s human nature), which unfortunately often sets the scene for what is to come. Because the price sets concepts in people’s minds. While everyone would love to have a Ferrari, almost nobody can afford one, so we shop in our price range.

And if there is only one evaluation team to evaluate both the technical and pricing aspects of a tender, there are risks:

1. The team will likely focus on the price, not the technical capability, because the price sets an expectation of capability (or lack thereof). The two extremes of this concept are arguments such as, “they are way too expensive for us” or “that’s cheap, obviously they can’t do what we want”. The result is that the technical evaluation process is “coloured” by these concepts, and thus not a lot of effort may be put into evaluating the tenders that are deemed to be either too expensive or too cheap, when in fact this might not be the case after a “whole of life” price comparison is undertaken.

2. The technical people may not have a lot of financial skills and may be tempted by a low up-front cost without considering the potential “whole of life” cost. A pricing evaluation team comprising finance people generally look at things differently than technical people who are not skilled in finance.

3. But if a 2-team approach is used, it is necessary that the team leader is on both teams, so as to ensure that an “apples and apples” pricing comparison is made when different technology approaches have different price structures.

4. The obvious downside is that the 2-team approach may increase workload and make the process more complex than it otherwise needs to be.

Personally, I have found that a 2-team approach is the best for large tenders which have a lot of functional categories and many pricing options. But for smaller or straightforward tenders, a 1-team approach is often the best.

The 2-team approach also spreads the risk and uses technical people for the technical evaluation and finance people for the pricing evaluation, so it’s a better application of skills.

So, how will your next tender evaluation go?

#17 – Can you change the rules in the middle of a Tender Evaluation?

Probity rules allow for releasing an Addendum (eg to change the submission date, clarify some wording, etc), but Probity rules are definitely against changing tendering rules after release.

There are several reasons for this:

· It is against probity rules, which are defined in the Australian Federal Government “Financial Management and Accountability Act 1997”.

· The companies that respond to a tender put a lot of time and effort into submitting their response and they do this in accordance with the rules posted with the tender knowing that if they don’t conform to the rules, they might be rejected. So (quite rightly) they don’t like it if the tendering organisation tries to change the rules when they can’t. The result could be that they complain to the CEO or head of the Department of the tendering organisation and could succeed in having the tender overturned.

· It highlights that the team running the tender don’t know what they are doing and that they don’t have a Tender Evaluation Plan signed off by the Project Sponsor. If they did have a TEP then they wouldn’t be able to change the rules mid-tender.

· It tends to indicate that the Evaluation Team are trying to favour one vendor over another which will likely result in a complaint being lodged and the tender process overturned, or in extreme cases, may result in corrupt action.

So, the message is to get it (the tender) right the first time. Make VERY sure that every requirement that is listed as Mandatory is really mandatory, knowing that if a vendor does not meet that Mandatory, then they will be rejected. Of course, if a vendor doesn’t meet a Mandatory, and are not rejected, and their competitors find out …

So, how will your next tender evaluation go?

#18 – The subtle art of Tender Negotiation

A simple tender often has a simple outcome. You accept the price and sign the contract, the software is implemented and the work starts.

But most tenders, particularly GIS tenders, involve some negotiation. Some (mainly Federal) government agencies call this the BAFO stage – Best and Final Offer. That is, when you have (usually) two remaining bids – both suit your requirements, both have a price which is acceptable and you could “live with” either bid. So, the standard process is to negotiate with each vendor knowing that you have the other as a fall-back to get a better deal.

The “better deal” may be a cheaper price, or more software, or more support, or on-site support, or free training, etc. It’s a bit like buying a car – you’ve decided on the type of car, model, colour, etc and you are trying to get the best price between two dealers. Maybe one offers an extended warranty, or a free tank of fuel, etc.

When it’s your money buying the car, you try and get the best price. Similarly, when you’re buying a GIS, you should do the same.

But in this process, it’s important to recognise that the vendor will have limits to how far they will go as well as processes that they have to follow. On the one hand, you want to get the best deal, but you don’t want the vendor to “go broke” or for the deal to be so hard on them that they are unable to meet their obligations. Because in the end that does you no good.

Recognise also, that most vendors will keep something back to offer up at the BAFO stage, so if you don’t go through a BAFO you will likely end up paying more.

So, how will your next tender negotiations go?

#19 – EOI of Just RFT for the tender?

When tendering, a question often asked is whether to go out for an Expression of Interest (EOI) before the RFT. The major advantage of an EOI is that the EOI allows you to review / evaluate the market without commitment and to do this in a more informal manner. You then might want to include some of these requirements in the RFT or to modify the RFT procurement process substantially.

Typically, the EOI discusses the intention of the procurement for software to address business issues / process. The RFT, on the other hand, is usually more specific and discusses particular requirements.

The disadvantage of including an EOI is that it adds an extra step and therefore takes longer and is more costly. But the EOI does provide the ability to do a quick market scan and form a short list (preferably 3-5) of serious vendors without a lot of work. Otherwise, if you went to the market with an RFT you may have 10-15 responses and have to do a detailed evaluation of each – all of which may take a long time.

So, an EOI might save time by limiting the detailed RFT evaluation to just a 3-5 shortlist rather than a 10-15 list of vendors.

Generally, a price is not sought in an EOI because the specification is generally not detailed (and will likely change at the RFT stage) and because a contract won’t result from an EOI, any prices given will mostly be meaningless.

And because the EOI is an information gathering process, not a procurement process, it provides the opportunity for more customer staff to attend product demonstrations and to socialise the capabilities of a GIS before it becomes a more formal evaluation process.

Of course, some agencies have a history of purchasing off an EOI without an RFT, but that is rare.

So, will your next tender have an EOI stage or just an RFT stage?

#20 – Debriefing the Losers

One of the least planned tasks in a tender process is to debrief the losers.

This is often because the focus is usually on selecting the winner and the other bidders who have lost tend to fall by the wayside. But the losers are important too. They have put a lot of work into their tender submission and deserve to know why they lost, hopefully so it will be a learning process which can be applied on their next tender.

And it is important that the losers are satisfied with the reasons given for why they lost, otherwise they might be tempted to put in a complaint. This is because most vendors have an “almost religious” belief in their own product, so they are generally suspicious about how another product could be better.

So, while the tender evaluation process is about selecting the winner, it should also be about identifying the losers and gathering ammunition for why they have lost. This ammunition can then be presented at the debrief session to show each vendor why they have lost, and to do so in clear and unambiguous terms.

Having good ammunition takes the focus off the emotive issues such as “you didn’t like our presentation” to being about concrete and indefensible issues such as “you were unable to complete Scenario 3” or “your price was 23% higher than the winning bid”.

The debrief session should also be about why they lost (using the ammunition collected) not about why the winner won. This is crucially important, so that the discussion focuses on the losers’ shortcomings rather than it being a debate on the winner’s capability.

In the end, if the losers are not satisfied with the reasons given for their loss, then they may lodge a complaint which will involve a whole lot of hurt for the evaluation team. So, it’s best to avoid this and do a professional debrief – after all, the losers deserve it.

#21 – Why do you need a Tender Evaluation Report?

The Tender Evaluation Report is a follow-on from the Tender Evaluation Plan.

The TEP is the plan BEFORE you start the tender, to describe to the team (and Executive) what you are planning to do in the tender, why you are doing it, what the steps are, how you plan to evaluate the tender and what the outcome(s) should be.

The Report, on the other hand, is at the END of the tender and is (should be) confirmation that the Plan was followed, with a summary outlining progress through the plan leading to the recommendation to award the tender to the successful company. This Report should provide the Executive with confidence that you know what you are doing, that a careful process has been followed and that a prudent decision is proposed.

The Report should also briefly describe why each loser lost (refer Top Tender Tips #20 on debriefing the losers) and why the winning company should be successful with the tender. The Report should also present a full description of the costs, payment milestones and balance against benefits.

The catchword for this Report should be “no surprises”. All issues should be disclosed and presented to the Executive such that they are left in no doubt about the “pluses and minuses” of all tender bids. All “grey areas” should be disclosed and any issues remaining in doubt should be put to the Executive for their decision.

The subsequent awarding of the tender and the procurement should then naturally flow from the Report and the Executive should be able to “follow along” as this happens.

The Tender Evaluation Report should therefore provide confidence to the Executive that “due process” has been followed, that you know what you’re doing and that you are focused on the “greater good” of the organisation.

Do this right and your career opportunities may improve. Do this wrong and it could become a “career limiting” move.

So, how will your next tender evaluation measure up?